Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out. Inflation is an economic concept that refers to increases in the price level of goods over a set period of time. The rise in the price level signifies that the currency in a given economy loses purchasing power (i.e., less can be bought with the same amount of money). When prepaid rent is paid, it increases the current assets on the tenant’s balance sheet.

What are Prepaid Expenses?

It is considered a current asset because it is expected to be used up within one year or one operating cycle, whichever is longer. Our lease accounting software automates the majority of the lease accounting process, making this complicated necessity quicker, more accurate, and more compliant. Prepaid expenses aren’t included in the income statement per generally accepted accounting principles (GAAP). In particular, the GAAP matching principle requires accrual accounting, which stipulates that revenue and expenses must be reported in the period that the spending occurs, not when cash or money exchanges hands.

What is Deferred Rent, and When is it Recognized as a Liability?

The spreadsheet would continue through December, displaying the amount that will need to be expensed each month. The journal entry above shows how the first expense for January is recorded. The non-government sector of accounting does not have a special rule for software subscriptions. This type of lease accounting is covered by Topic 350, which details intangibles, goodwill, and other types of lease accounting cases. In a nonpayment case, if you pay the full amount of the rent due to the court before the Marshal does the eviction, the Court must cancel the warrant of eviction.

Lease contracts

- It is a representation of rent payments made for future use of rental property.

- Prepayment is an accounting term for the settlement of a debt or installment loan in advance of its official due date.

- The accounting for accrued rent from the perspectives of the landlord and the renter are noted below.

- This advance payment is common in lease agreements and requires specific accounting treatment.

- Additionally, deferred rent is also recorded for lease agreements with escalating or de-escalating payment schedules.

- Other times organizations rent different types of equipment – such as office or maintenance equipment – because they require more flexibility than the ownership of property offers.

The consumer’s credit card company tracks these prepayments, so there is little need for the consumer to account for it personally. To estimate the amount of a prepaid asset’s monthly benefit, divide the total cost of the asset by the number of months of benefits the asset represents. The adjusting entry decreases the asset account and records an expense for the amount of benefits that have been used or have expired.

Create a Free Account and Ask Any Financial Question

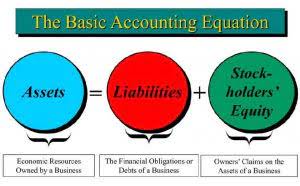

How a rental space is used affects what account the rent expense is listed under. We will increase the expense account Utility Expense and decrease the asset Cash. We will increase an asset account called Prepaid Rent and decrease the asset cash. To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation. Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received.We want to increase the asset Cash and increase the equity Common Stock.

- Interest paid in advance may arise as a company makes a payment ahead of the due date.

- Prepaid rent is considered a current asset because it is expected to be realized within one year or the operating cycle.

- Prepaid expenses are payments made for goods and services that a company intends to pay for in advance but will incur sometime in the future.

- It may be very hard to stop the eviction if the landlord has a judgment against you after a trial, or if you didn’t keep promises you made in a settlement.

- If the company classifies expenses into administrative and selling expenses, rent expense should be apportioned based on the space used by the administrative department and the selling department.

- This comparison of deferred rent treatment under ASC 840 and ASC 842 is illustrated in Deferred Rent Accounting and Tax Impact under ASC 842 and 840 Explained.

The above example illustrates how the accounting equation remains in balance for each transaction. In a scenario with escalating lease payments, the average expense recorded is more than the lower payments at the beginning of the lease term. Eventually, the lease payments increase to be greater than the straight-line rent expense. In the case of the rent abatement above, the company begins paying https://www.bookstime.com/ rent but the payments are larger than the average rent expense which includes the abatement period. The expense for the first two months has been incurred because the company has used the rented equipment or occupied the leased space, but cash for these services has not been paid.

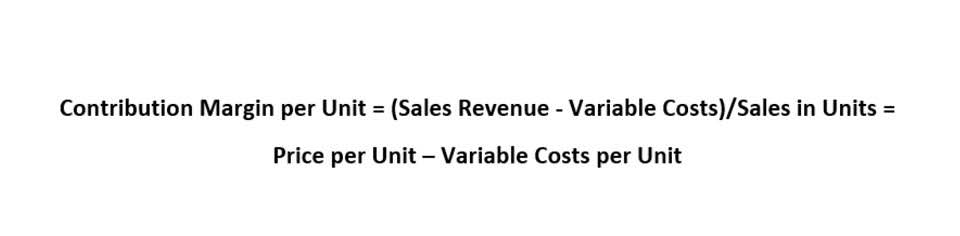

The matching principle is the basis for allocating expenses to the periods prepaid rent definition in which they are used or consumed. It requires that expenses be matched with the revenues they help generate. The matching convention requires allocation of the expenditure between the asset that represents the remaining economic benefits and the expense that represents the benefits used or consumed by the firm.

Accounting for accrued rent with journal entries

In short, organizations will now have to record both an asset and a liability for their operating leases. This is a significant change because under legacy accounting rules, the cash payments for operating leases were recorded as rent expense in the period incurred and no impact to the balance sheet https://www.facebook.com/BooksTimeInc/ was recognized. A landlord’s experience with these late payments may be so bad that it makes more sense to not accrue them at all, and instead only record revenue upon the receipt of cash .

Company

A prepaid expense, on the other hand, is any good or service that you’ve paid for but have not used yet. Accrued rent occurs when rent has not yet been paid or an invoice hasn’t been processed and the organization needs to record the expense. Accrued rent is a liability on the Balance Sheet and is reversed when paid or when an invoice is posted.