Blogs

In the 2024, the brand new finances deficit is determined to boost considerably more regarding 2023. Excluding attention will cost you and you will adjusted to possess accounting more than college loans, the newest shortage within the fiscal 2023 to get rid of-September is actually an excellent trillion dollars. To make things worse, government entities is actually ensnared inside the a stressing financial obligation trap.

- Subsequently, money financing has transferred to the brand new Treasury bill industry as an alternative, reducing the Fed’s reverse repo studio from a top away from $dos.55 trillion in the 2022’s year-prevent, amounting to regarding the a dozen% away from M2 currency also provide during the time.

- Anyone is always to assume that all of the information within all of our newsletter is actually not reliable unless confirmed by the her separate search.

- Make sure to take a look at for every agent’s profile and history of customer issues because of characteristics like the Better business bureau.

- Areas do not always wade directly or all the way down inside rates, and you can silver is no different.

China’s renminbi (yuan) coverage – Book Of Cats win

- If you plan to offer thanks to an online site, make sure that your gold are made sure one which just ship they, Kristof indexed.

- Should your financial policy producers in reality manage to reduce the Given Finance rates prior to he could be powered higher will probably trust whether the buck continues to weaken materially to the foreign exchanges.

- To see which kind of gold bullion products are eligible for silver IRAs take a look at our IRA Eligible Silver webpage.

Higher genuine interest levels communicate with lower silver cost, when you are lowest actual rates correspond that have high gold rates, he says. This is because there is an opportunity cost from the play, in which people must consider the amount of money they could create out of almost every other possessions, for example bonds, as opposed to silver. Has just, gold has been on the upswing, with many buyers embracing so it rare metal to try to prevent large inflation and financial suspicion. April watched listing silver cost away from just more than $dos,400 for every ounce, and over during the last seasons, gold prices for every ounce went upwards as much as 16%, considering Globe Silver Council study.

Simple tips to Calculate The price of Your own Silver Goods

Bear in mind that both Asia and you can Russian international rules is actually not to ever interfere regarding the home-based government away from most other nations but to follow their own federal hobbies. For this reason, the Book Of Cats win fresh expansion of Chinese financial borrowing from the bank tend to speed the brand new industrialisation of Deeper Asia to your complete advantage of China’s savings. As long as the fresh to find strength of the yuan are stabilised, so it petro-yuan rules cannot simply enable it to be, but build put aside and commercial need for the fresh yuan. For the yuan prospectively replacement the usa dollar, we are able to see that the brand new buck’s hegemony will also be substituted for that the fresh yuan. Regarding bank borrowing from the bank, so long as borrowing try extended for active objectives it’s maybe not inflationary. Admittedly, in the current many years lender credit has been much more inflationary because the individual credit has increased.

View the price of gold a variety of currencies international and different schedules. Historic gold costs are taken to framework and help update funding choices. Even when gold’s location costs are nevertheless trading lower than $step one,750 an ounce, the genuine cost of silver is a few hundred dollars high, according to Ed Moy, former U.S. Web sites casinos generally offer German players the opportunity to gamble inside the any kind of currency is best suited. That could be real money inside the You Bucks, Canadian Cash, Euros, High United kingdom Weight or other legal-tender.

I remark most of our very own checked blogs annually so we can be aim for it next roundup round and discover whether it usually defeat away the better picks. A well-recognized Swiss perfect having reduced premiums more location for bullion taverns supplies the best bet to own gold. A silver bar machined as damaged for the shorter silver chits ‘s the greatest option for endurance-versatile bullion.

Increased allowance than just one, even when, and you’lso are delivering too big a risk. Not just do you not know where individual sentiment will go moving forward, you could progress output somewhere else. The newest S&P five hundred constantly outperforms silver (carries is actually upwards eleven.40% over the past ten years) and offers relatively predictable efficiency along side long-term.

Silver Costs For every Ounce, Gram & Kilo

Gold can take advantage of an important role on your own economic plan, nevertheless shouldn’t be the bulk of disregard the collection. It is suggested that if you have to continue silver on your portfolio, restrict it to help you anywhere between step 3% and 6%, depending on your own risk reputation. The brand new You.S. central bank lower short-identity borrowing costs because of the 50 basis things.

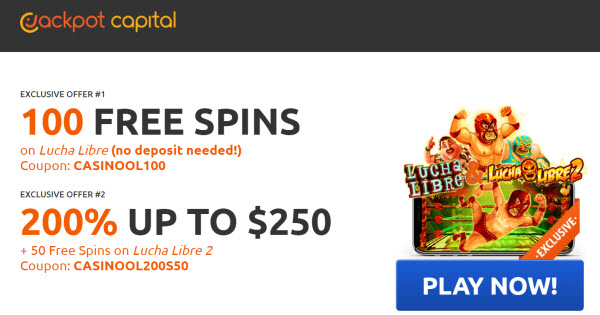

Need to gamble today? Investigate #step one real money local casino

That way away from convinced is becoming naturally the street to government bankruptcy, that may only be shown within the a keen quickening fall in a great fiat currency’s to shop for strength. The usage of ASF legislation was created to make sure the balance from a lender’s resources of borrowing from the bank (i.elizabeth., the newest deposit area of the balance layer). They is applicable a 50% haircut to help you large, corporate depositors, whereas retail dumps being considered a far more stable supply of investment, only suffer a great 5% haircut. Charged in the Us cash, not simply has the cost of crude started incredibly volatile however, by the June 2008 they had enhanced fifty-4 times. Hence, macroeconomists has an incident to resolve concerning the viability of its buck money replacement silver in character as the a steady typical of exchange.

Anecdotal research and you can team surveys confirm that in common to the other major G7 nations the united states try shedding on the an excellent deepening credit crunch. It is definitely consistent with industrial banking companies de-risking the balance sheets. For the moment, the united states Treasury is the significant recipient from borrowing moving out of the non-public field, confirmed by decline of your own Provided’s contrary repo business towards T-debts. Industrial banks is also anticipated to set what nothing liquidity he has on the the forex market too. During the 14 moments, it offers hardly managed to move on lower from 2021’s top, reflecting the problem with which the whole financial cohort has inside reducing its cumulative equilibrium piece.

What is the best way to start to buy silver?

Historically, expanded models portend bigger outbreaks with a wide ft signaling an excellent larger upside situation. Flow of good, trusted money is endless yet , you can find tight restrictions to Bitcoin. It does have their spends in terms of funding and you will emergency, however, we don’t find it while the a totally extremely important little bit of any package or plan. When you want good value to suit your dollar, you’lso are gonna have to consider pubs.

Put differently, commercial banks started to deny high put balance less than Basel 3 NSFR legislation at the same time while the another group of financing risks started to materialise. Subsequently, money finance provides moved to the brand new Treasury expenses business as an alternative, decreasing the Fed’s reverse repo business away from a high from $2.55 trillion from the 2022’s 12 months-end, amounting to help you on the twelve% away from M2 currency likewise have during the time. Ahead of in 2010-end’s prospective window-dressing they stands at the $772 billion. The original point to notice would be the fact anywhere between 1950—1971, the price of oils inside bucks is interestingly steady that have almost zero version. It absolutely was and the time of the Bretton Trees contract, which was frozen inside the 1971. Bretton Trees fastened the newest buck’s credibly to help you gold, until the extension out of money credit became as well just the thing for the newest contract to happen.